Media Centre

Read our latest news and features, find out about our extensive programme of events or discover what we do and how we have helped other businesses in our video library

Media sections

-

-

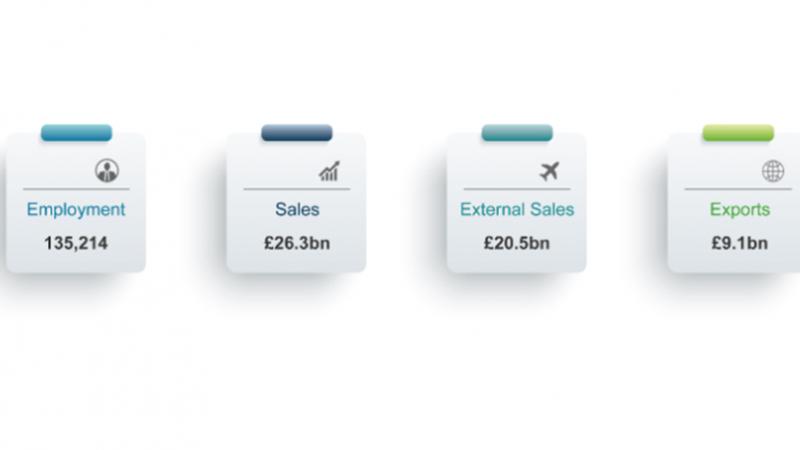

Invest NI supported businesses show increases across all KPI's, with External Sales surpassing £20bn for the first time

The results measure the change in Employment, Sales, External Sales and Exports in businesses that have received Invest NI support.

-

Key Performance Indicators 2022

Invest NI Key Performance Indicators (KPIs) provide information on the size and performance of Invest NI account managed businesses.

-

Economic and Market Intelligence

Summary of Invest NI and assorted Northern Ireland statistics.

-

Publications and reports

Search here for a list of publications and reports in your area.

-