Want to know more about our support?

News

£3 million investment in Coleraine companies will improve outcomes for cancer and metabolic disease patients

25 June, 2025

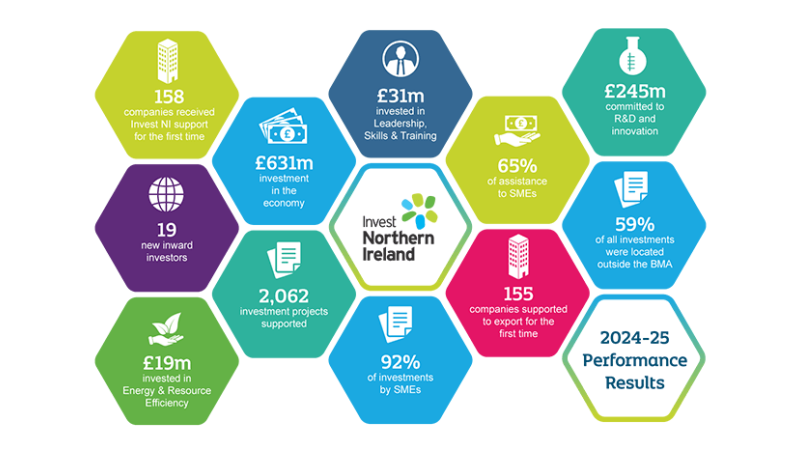

Invest Northern Ireland has announced that two Coleraine SMEs are the first to receive investment from its £39 million equity fund, Co-Fund III.

Minister welcomes US trade successes

07 May, 2025

Invest Northern Ireland appoints key leadership roles

03 April, 2025

London based Napier AI to create over 100 jobs in the north

18 February, 2025

CIGA Healthcare secures £1.4m contracts in the US and Europe

17 February, 2025